Breaking News

Fast, Reliable, and Uncensored News Coverage

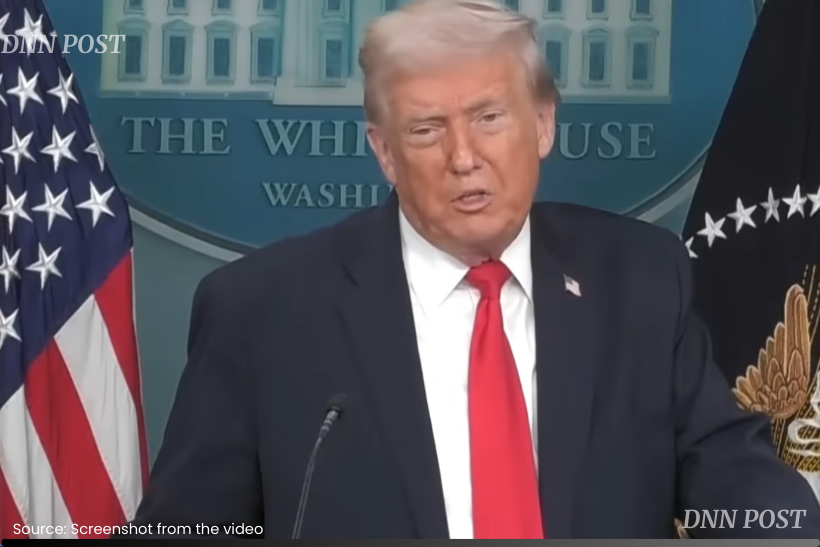

MLN -28 JAN 2026: The Federal Reserve is expected to keep interest rates unchanged Wednesday, pressing ahead with a pause in its easing cycle despite mounting political pressure from President Donald Trump and a Justice Department criminal probe involving Fed Chair Jerome Powell.

The Federal Open Market Committee is widely anticipated to leave its benchmark borrowing rate steady after cutting rates at its previous three meetings. Economists say officials remain concerned that inflation has proved stubborn even as economic growth shows signs of slowing.

“After cutting interest rates at each of the last three meetings, we expect the FOMC to take an extended pause,” Michael Pearce, chief U.S. economist at Oxford Economics, wrote in an analysis. “While the near-term policy outlook is benign, events outside the committee have the potential to shake up the path of monetary policy.”

The January meeting is the first since Powell confirmed that he and the central bank are under criminal investigation by the Justice Department, formally related to the handling of building renovations. The probe has been sharply criticized by lawmakers, economists and foreign central banks as an attempt to influence monetary policy and undermine the Fed’s independence.

Powell has publicly rejected that characterization. In a video statement earlier this month, he described the investigation as a pretext to pressure the Fed into cutting rates and said he would not yield to political demands.

“Ongoing tensions between the Federal Reserve and the White House elevate what might otherwise have been a quiet January meeting into a more sensational event,” said Stephen Kates, a financial analyst at Bankrate.

Powell’s post-meeting news conference Wednesday will be his first since the Justice Department launched the probe and defended the Trump administration’s effort to remove Fed Gov. Lisa Cook, a case now before the Supreme Court. Powell attended oral arguments last week, where several justices questioned whether greater presidential control over the Fed could threaten its independence.

“With Powell having stated publicly that the Trump administration was trying to erode Fed independence, journalists may question him on whether he and the Federal Reserve see limits to Fed independence or room for coordination with the administration,” Steve Englander, head of North America macro strategy at Standard Chartered, wrote in a note.

The political backdrop adds to divisions already evident within the Fed. At its last meeting, the FOMC voted 9-3 to cut rates by a quarter point, the largest number of dissents since 2017. Two members favored holding rates steady, while Gov. Stephen Miran, currently on leave to serve as Trump’s top White House economist, pushed for a larger half-point cut.

Trump has made no secret of his frustration with Powell and has signaled his desire to appoint a new chair more aligned with his views. Powell’s term as chair runs until May, though he could remain on the Fed’s board until 2028.

“The chair holds one vote on the committee, with the real power being able to steer the committee’s direction of discussion and research among the board staff,” Pearce wrote. “With the committee’s divergent views, any chair will find it challenging to build a consensus for a significantly different policy direction in the near term.”